Regulatory expectation for risk-based decision making is increasing in anti-money laundering compliance laws. Risk-based decision making requires expertise in practical application of risk management processes, as well as financial crime expertise.

Additional to minimum levels of knowledge, businesses require systems for ongoing. monitoring.

These costs are significant but with AML RegTech, businesses obtain solutions that include inbuilt knowledge and automated reporting to inform of compliance issues.

Businesses that struggle to maintain compliance should experience the benefits of AML compliance monitoring systems.

AML/CFT compliance is an ongoing obligation. This requires risks and the AML/CFT compliance status to frequently be reviewed.

Managing AML/CFT compliance obligations is streamlined with automated data processing. AML compliance obligations and regulatory controls should be readily demonstrable.

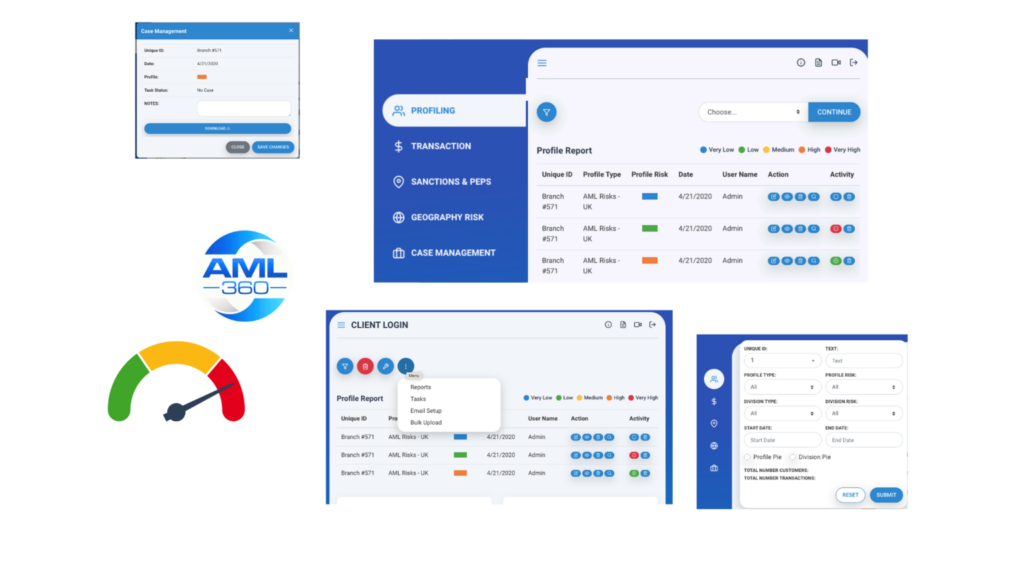

AML360™ Regulatory Technology (RegTech) has proven to be a formidable driver of efficiency in AML compliance. For AML

Compliance Officers, manual processes are eliminated and best practices automated.

When utilising a software-as-a-service solution (SaaS), businesses can operate systems and workflows remotely, ensuring business continuity for AML compliance.

With solutions such as AML360’s fully tailored end-to-end suite of AML compliance tools, AML RegTech and AML SupTech (Supervisory Technology) are setting a new precedent for enhanced compliance processes.

AML360’s RegTech is the perfect solution for now and into the future as governments increase regulatory expectation of AML/CFT compliance. The increasing expectations of risk-based compliance will require AML/CFT Compliance Officers to embrace digital solutions. In doing so, AML Compliance Officers will appreciate the elimination of labour intensive processes achieved from automation of administrative duties.

Furthermore, it is likely the executives and senior managers will receive greater efficiencies through automated risk-based governance reports.

AML360™ provides solutions to banks, money remittance services, casinos, foreign exchange trader, lawyers, accountants, financial service business and real estate agents.

Self-manage your digital AML/CFT compliance framework or get AML outsourcing services. Discover the speed of digital implementation and ease of maintaining an AML/CFT compliance framework.