Regulatory Technology

AML Risk Assessment: what you need to know

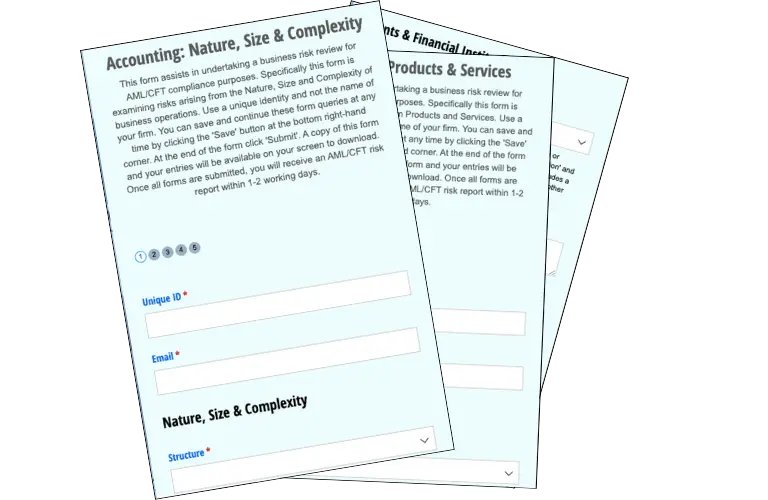

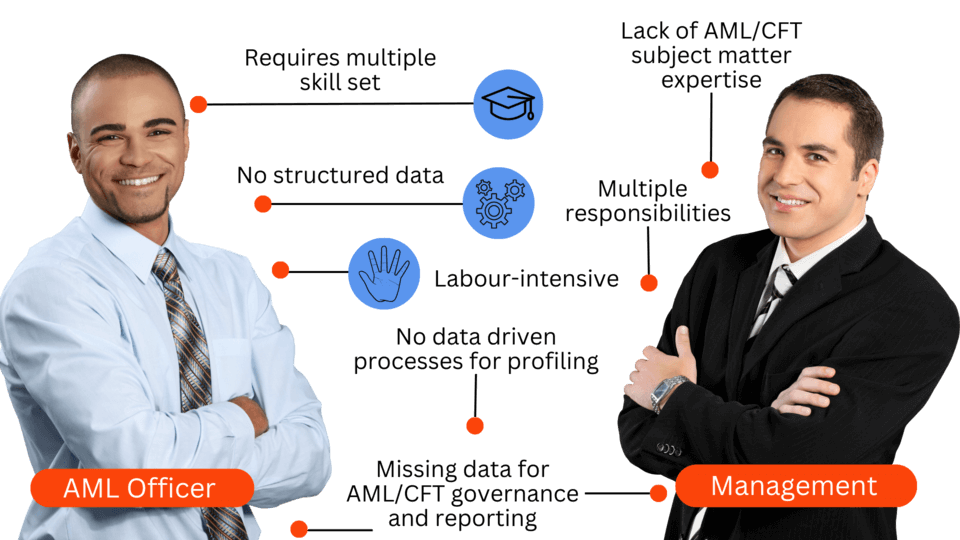

An adequate AML Risk Assessment Report is crucial in designing an AML/CFT compliance framework. Yet surprisingly, AML/CFT risk reports often fail to meet regulatory expectations. Despite the importance, few businesses operate with an adequate risk methodology. These businesses become low-hanging fruit for regulatory action. AML360™ regulatory technology automates the technicalities of an adequate risk methodology. Equally, the AML/CFT assessment report reasonably informs business owners and AML compliance officers of the risks they must manage.