Businesses responsible for managing Anti-Money Laundering (AML) compliance obligations should, if not already, be using Regulatory Technology (RegTech) when undertaking AML risk assessments.

Even with a small number of clients and transactions, the use of RegTech to support AML compliance should not be ruled out until the human resourcing (HR) costs have been considered. This is because every hour an employee commits to an AML/CFT compliance obligation is taken away from dedicating to core business activities. For small businesses relying on manual AML/CFT compliance processes, this can be a costly and ongoing distraction. AML compliance needs constant attention. Auditors and AML supervisors can test the effectiveness of systems. Non-compliance can result in high regulatory penalties and impact the company brand.

Small businesses should be thinking smarter about managing their AML compliance obligations. The time spent researching the most effective regulatory compliance solution will likely be well spent.

A search of AML software providers will return results of vendors providing 1 or 2 definable aspects of the entire AML compliance framework. When a compliance framework relies on multiple providers, data will likely sit in silos, causing risk analysis to be prolonged and inefficient. A single sign-on platform that provides a solution for every aspect of the compliance lifecycle means lower costs, centralisation of data and the ability to efficiently manage risk and compliance on an ongoing basis.

AML360 is a unique global RegTech solution allowing AML/CFT compliance to be managed, end-to-end, from a single digital platform.

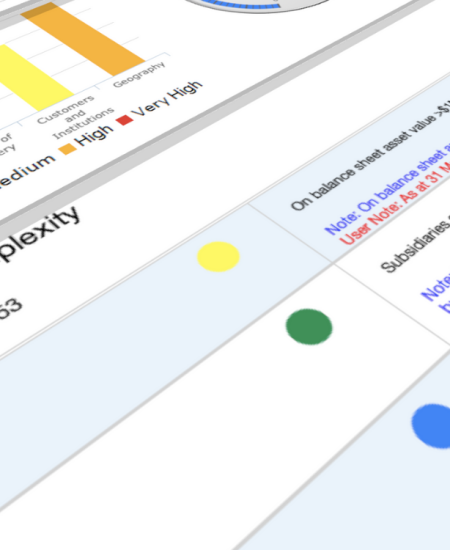

A compliance obligation that is notoriously criticised for lack of objectivity and adherence to regulations is the business risk assessment. Businesses at all levels often fail in adequately evaluating their inherent risks. In doing so, they are failing to understand their most vulnerable areas and unless those areas are operating with adequate controls, the business will have greater likelihood of facilitating money laundering or other types of financial crimes.

This is why the business risk assessment is widely recognised as the first step to complete when developing an AML/CFT compliance framework. When the inherent risks are known, AML compliance officers, business owners and managers are obligated to develop policy and design controls to effectively manage those risks. Effectively managing risks and having oversight of controls increases the likelihood of meeting all regulatory requirements.

AML360’s platform has been designed as an end-to-end solution to allow SMEs to manage every aspect of AML compliance. The product can be preconfigured to ensure legislative requirements are met. The user simply selects data and ‘clicks’ the mouse. There are options for batch uploads of large data, such as client risk profiling.

AML360 also has RegTech solutions for banks.

If you want to see a demonstration – get in touch!