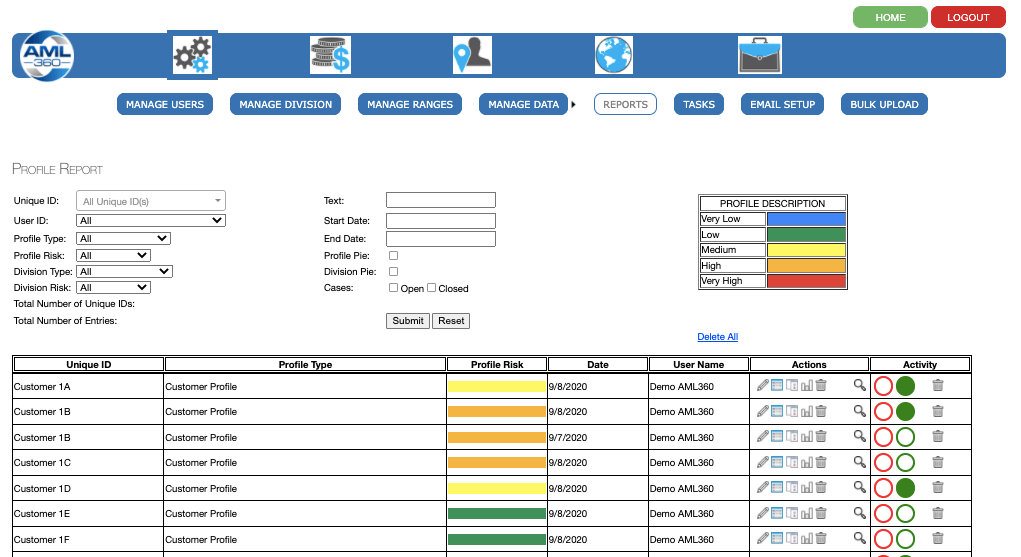

Money Laundering Risks

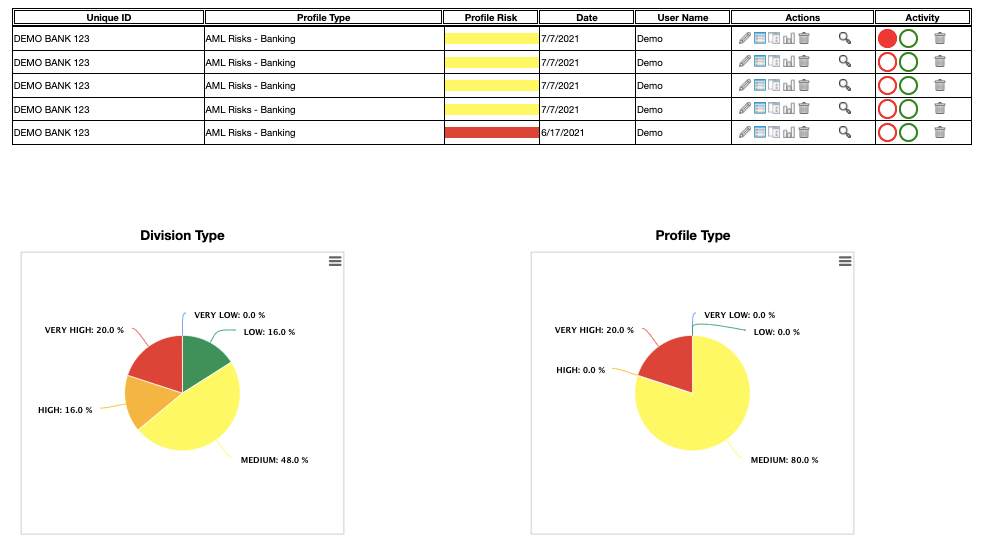

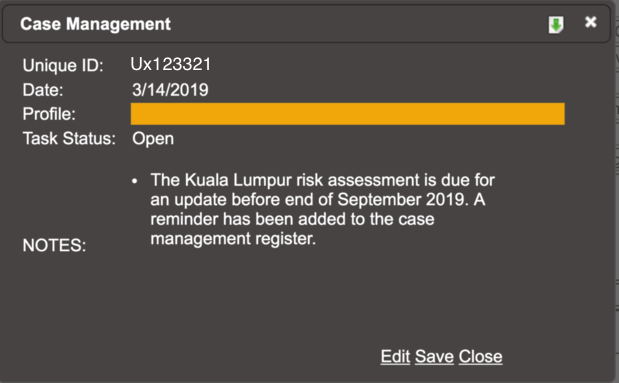

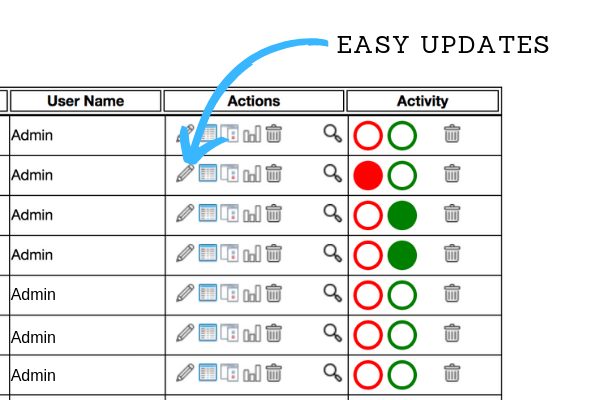

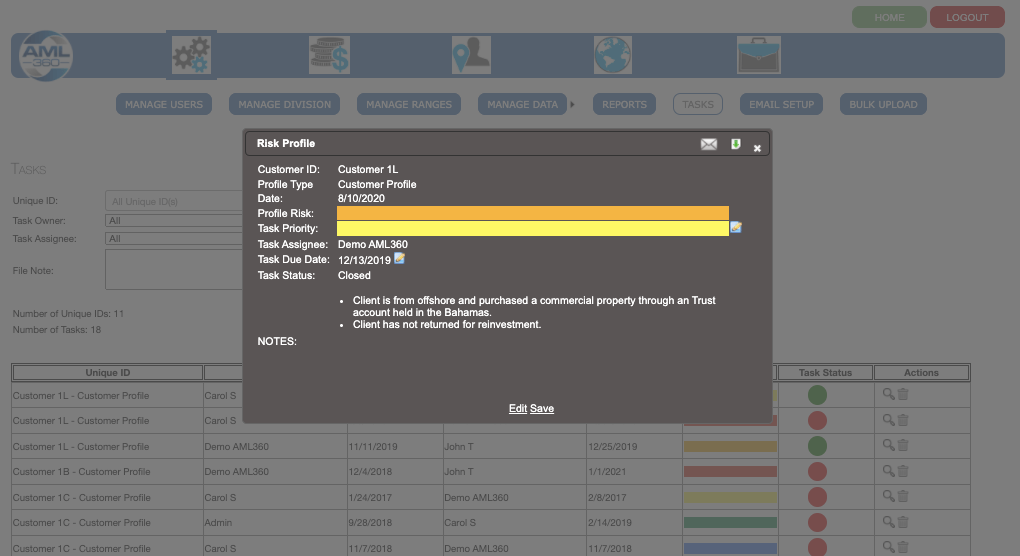

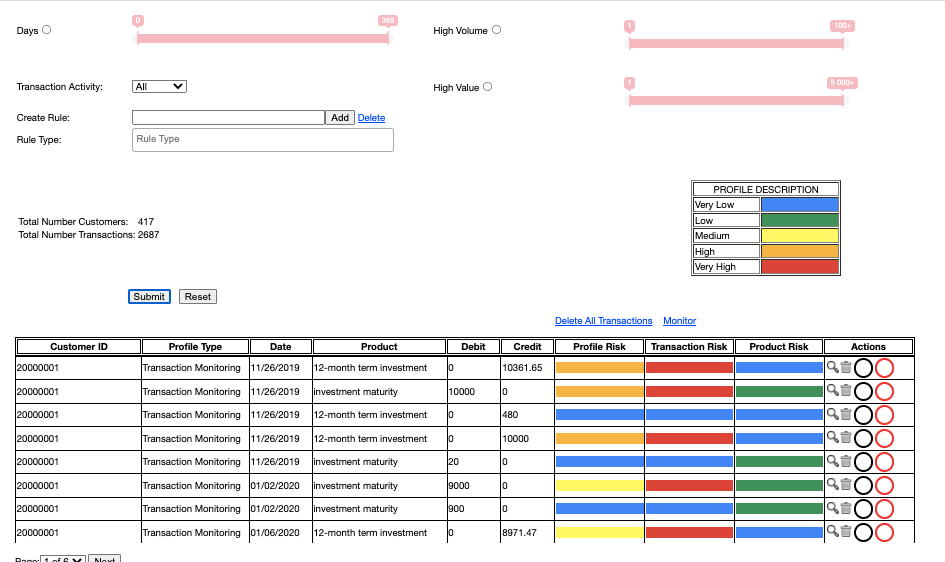

AML compliance professionals can single-handedly manage money laundering risks from their AML360 account. Money laundering risk assessments and profiling is available for business assessments, customer profiling, transaction monitoring, geography risks. The AML360 platform is delivered tailored to the nature, size and complexity of the industry and business entity.