By relying on regulatory technology known as Compliance-as-a-Service, businesses of all sizes can take advantage of AML360’s digital compliance platform. Whether you are the Head of Risk at a tier 1 bank or an owner/operator of a small legal or accountancy firm, AML360 provides the easy-to-use technology for measuring your AML/CFT risks.

AML360 provides risk reporting for all businesses obligated under AML/CFT laws requiring a ‘risk-based approach’ to the evaluation of business operations.

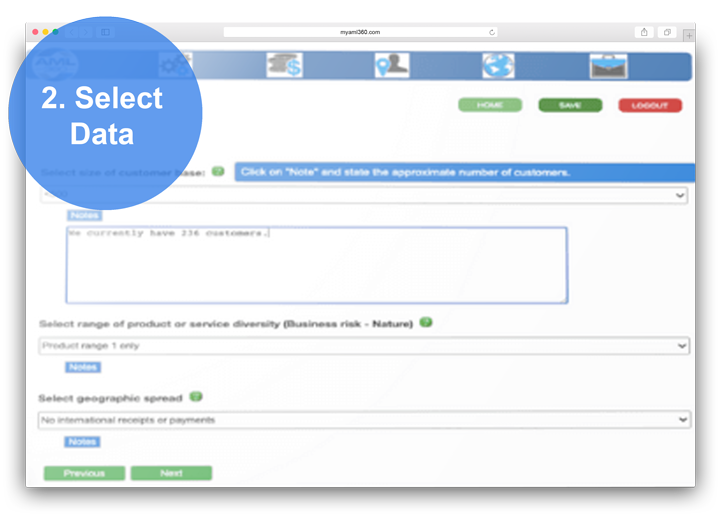

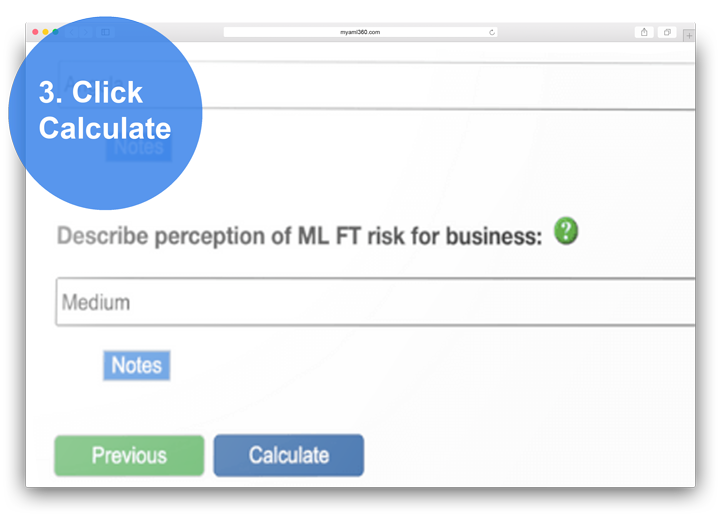

Login, select data on screen, click Calculate. Your report is ready.

A comprehensive risk guidance manual is included with your report. This allows your business to fully understand the risk methodology and results.

AML/CFT business risk assessments drive the expected strengths of procedures and controls to reduce inherent risks and manage ongoing risks. The risk analysis process should have the capability of undergoing testing by independent auditors and AML/CFT Supervisors. AML360’s technology incorporates descriptions of the risk-based application for measuring money laundering and financing of terrorism risks across business divisions.

Over the past 5 years, AML360 has consistently ranked as a leading, innovative vendor, providing Software-as-a-Service. Focusing on anti-money laundering compliance, AML360 provides a single platform for managing every aspect of AML/CFT regulatory obligations. This includes client onboarding, client profiling, country risks, account monitoring and governance tools for management reporting.