Plug & Go!

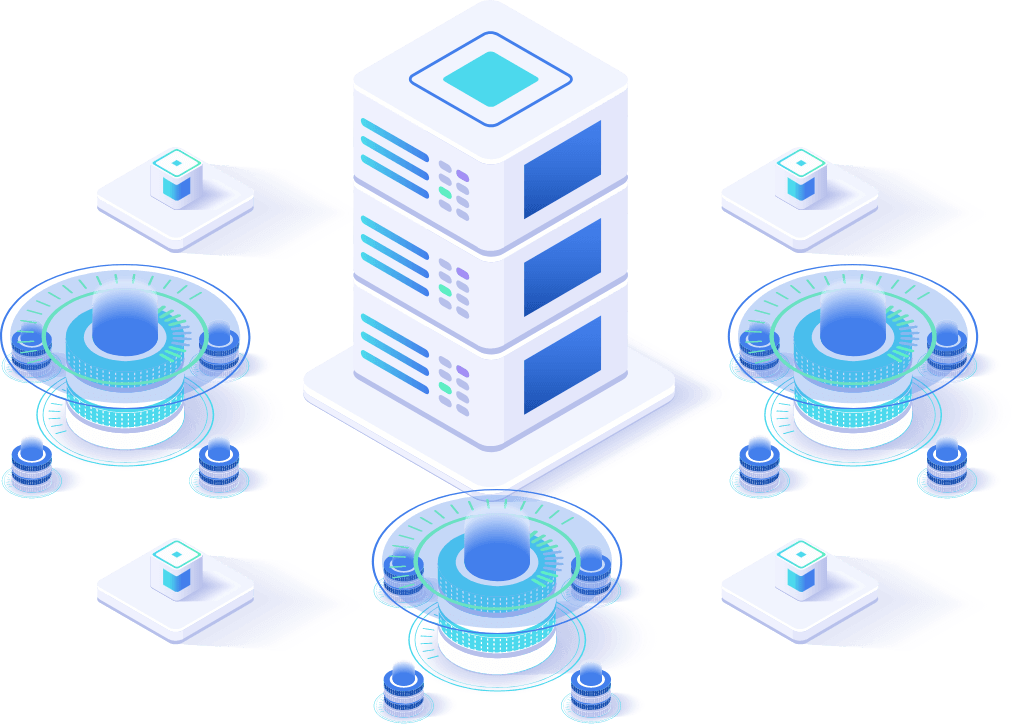

This AML firm-wide assessment software has been designed by AML/CFT academics and former advisers to the government. Already configured to the regulatory risk-based approach, you log in and go. Commence with providing an email for the report to be sent. Then, select data from the screen, add notes, and click 'Calculate'. Your report includes a narration of the level of risk exposure. Heat maps make it easy to quickly identify hot spots. Your guidance manual makes it easy to interpret the risk methodology.

- Intuitive dashboard

- Customised reporting

- Risk methodology explained

- Less than 60 minutes to complete