A money laundering risk assessment report identifies areas of business operations that are exposed to facilitating money laundering or terrorism financing. Access to an AML360 account will produce an AML business risk report within an hour. Thereafter, updates of AML/CFT assessments take minutes.

Governance, Risk & Compliance Reporting

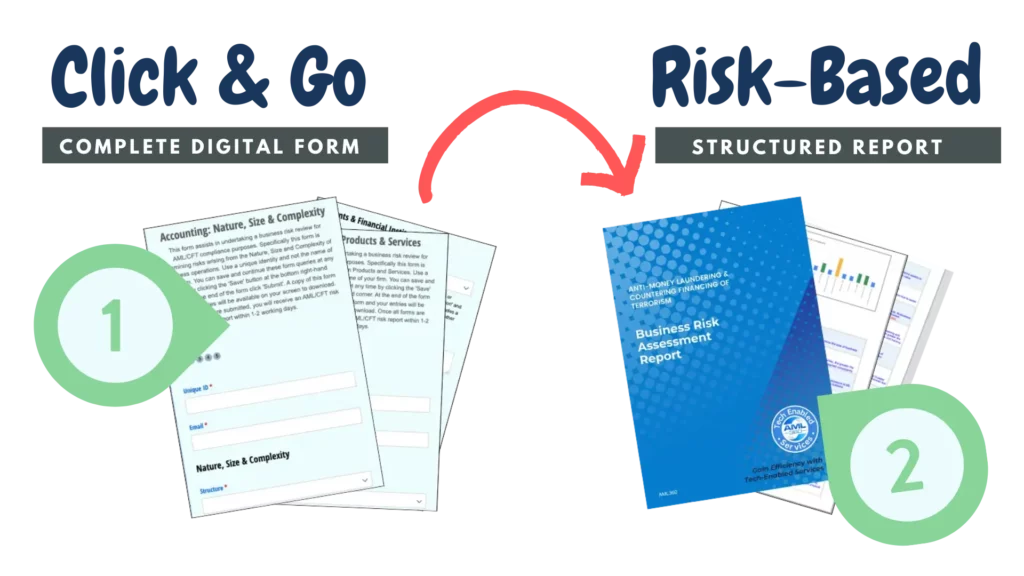

Anti-Money Laundering Compliance requires risk profiling, monitoring and reporting. If your business is struggling with the firm-wide money laundering risk assessment, AML360™ will remove all complexities. The software provides you with an online form which you submit to receive a comprehensive risk report of your firm-wide AML/CFT risk exposures.

When a business relies on manual processes, the human labour intensive resource increases compliance costs. AML360 has resolved these issues with a fast and online AML risk assessment.

Through application of regulatory technology, our digital solution embeds professional advisory services into your risk report, increasing efficiency and further reducing costs.

The AML risk assessment is available for all countries, across all industries, to meet regulatory compliance. Simply login, select data from screen options, then click calculate.